Introduction

Two-factor authentication (2FA) is a security feature we have come to expect as standard by 2024. Most of today’s websites offer some form of it, and some of them won’t even let you use their service until you enable 2FA. Individual countries have adopted laws that require certain types of organizations to protect users’ accounts with 2FA.

Unfortunately, its popularity has spurred on the development of many methods to hack or bypass it that keep evolving and adapting to current realities. The particular hack scheme depends on the type of 2FA that it targets. Although there are quite a few 2FA varieties, most implementations rely on one-time passwords (OTPs) that the user can get via a text message, voice call, email message, instant message from the website’s official bot or push notification from a mobile app. These are the kind of codes that most online scammers are after.

Malicious actors can obtain OTPs in a variety of ways including complex, multi-stage hacks. This article examines methods that rely on social engineering, where attackers manipulate the victim into giving away the OTP, and tools that they use to automate the manipulations: so-called OTP bots and administration panels to control phishing kits.

What is an OTP bot?

The use of OTP bots to bypass 2FA is a relatively recent online scam trend that poses a major threat to both users and online services. An OTP bot is a piece of software programmed to intercept OTPs with the help of social engineering.

A typical scam pattern that uses an OTP bot to steal 2FA codes consists of the following steps:

As you can see, the OTP bot’s key task is to call the victim. It is calls that scammers count on, as verification codes are only valid for a limited time. Whereas a message may stay unanswered for a while, calling the user increases the chances of getting the code. A phone call is also an opportunity to try and produce the desired effect on the victim with the tone of voice.

Bots may have functionality that varies from one script that targets the user of a certain organization to a highly tunable configuration with a wide range of scripts that let scammers replace a whole call center with bots. Bot developers compete by trying to include a maximum of features at a price that reflects the value.

For example, one OTP bot boasts more than a dozen features including 24/7 technical support, scripts in a variety of languages, female as well as male voices available and phone spoofing.

A list of features offered by a certain OTP bot

OTP bots are typically managed via a special browser-based panel or a Telegram bot. Let’s look at the example of how bots can be run via Telegram.

Available OTP bot subscription plans

The specimen at hand offers a variety of categories: banks, payment systems, online stores, cloud services, delivery services, cryptoexchanges and email services. While a call from the bank is something the victim might expect, a call from a cloud storage or email provider is not what we’d describe as completely normal. Yet, social engineering can be used to talk the victim into giving away a code provided by any type of organization.

A large number of available categories is admittedly more a marketing gimmick rather than anything else: scammers may feel inclined to pay for an OTP bot that offers more options. Most often, bots are used for bypassing 2FA required by financial organizations.

Organization category options

Manual entry of the bank name

Manual entry of the victim’s name

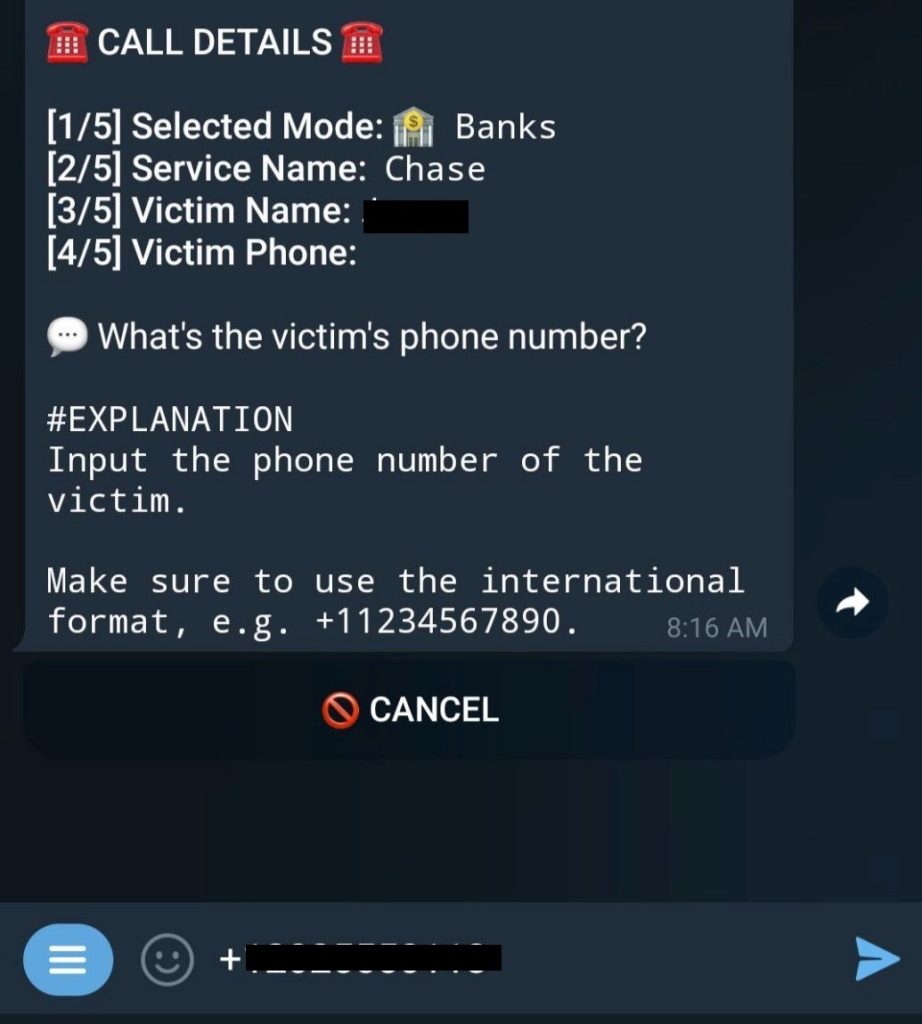

Manual entry of the victim’s phone number

The option to add the last four digits of the victim’s card number

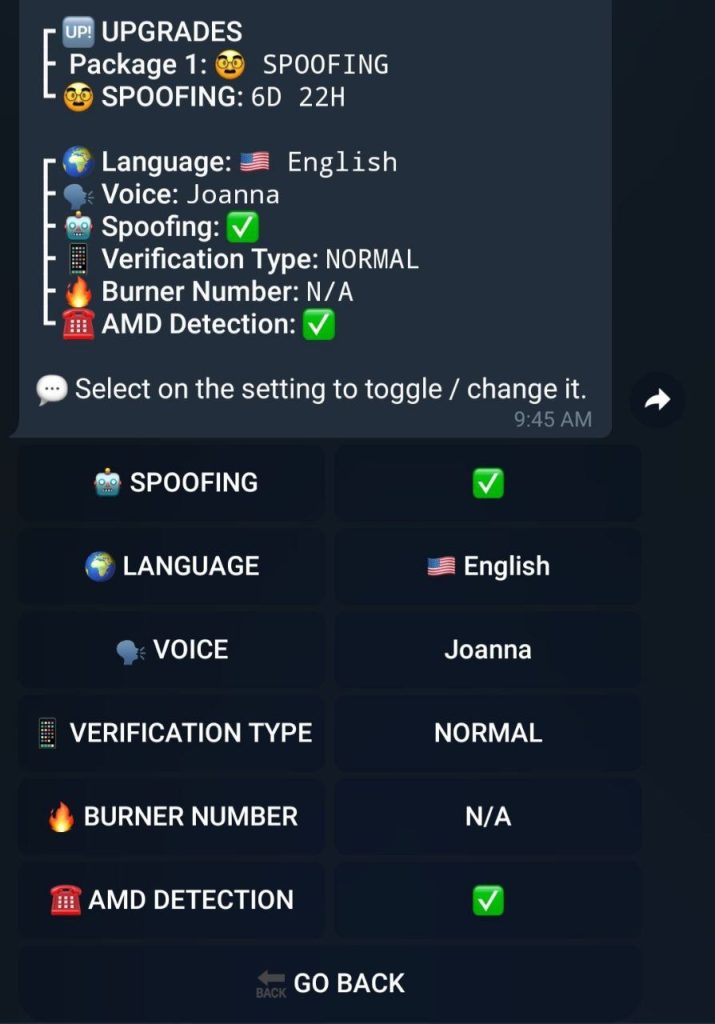

Advanced call options

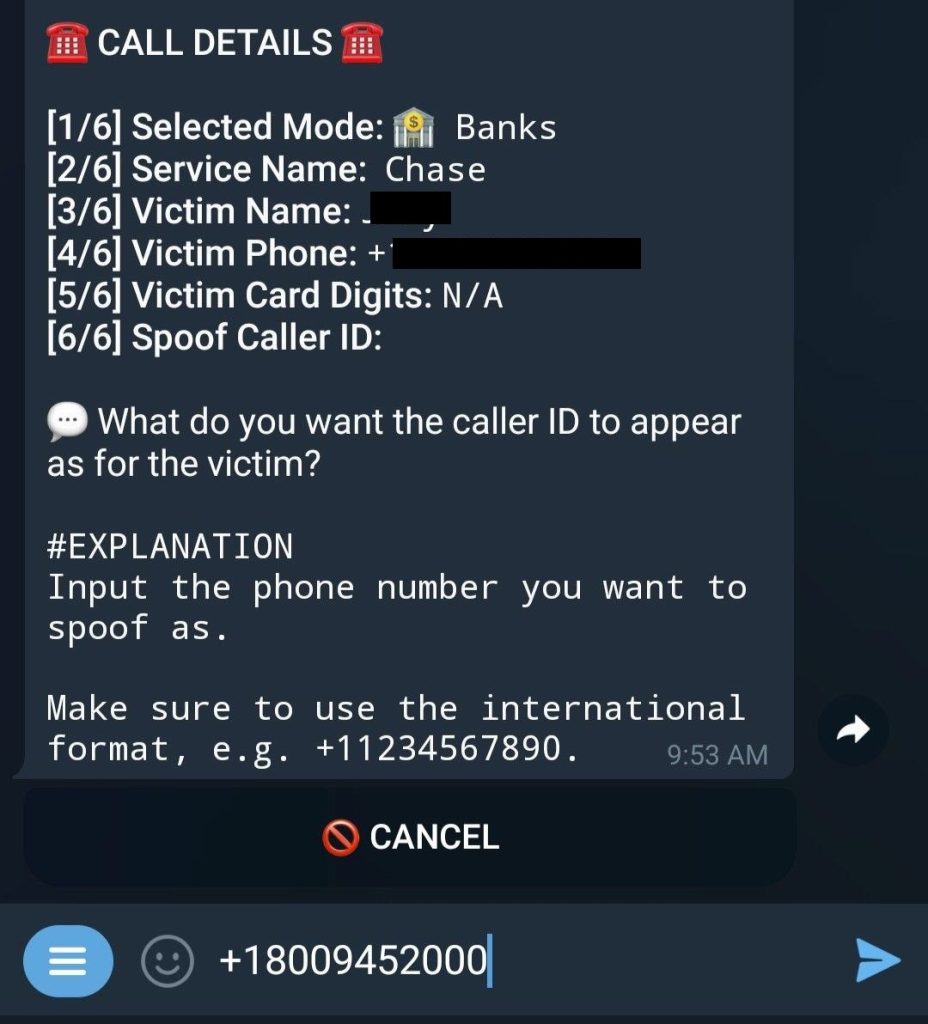

- You can turn on spoofing, too, but you’ll need the official phone number for the organization that the OTP bot is set up to impersonate. This is the caller ID that will be displayed on the victim’s phone screen when they get the call. The bot uses a random number unless this feature is enabled.

The option to specify the organization’s official phone number

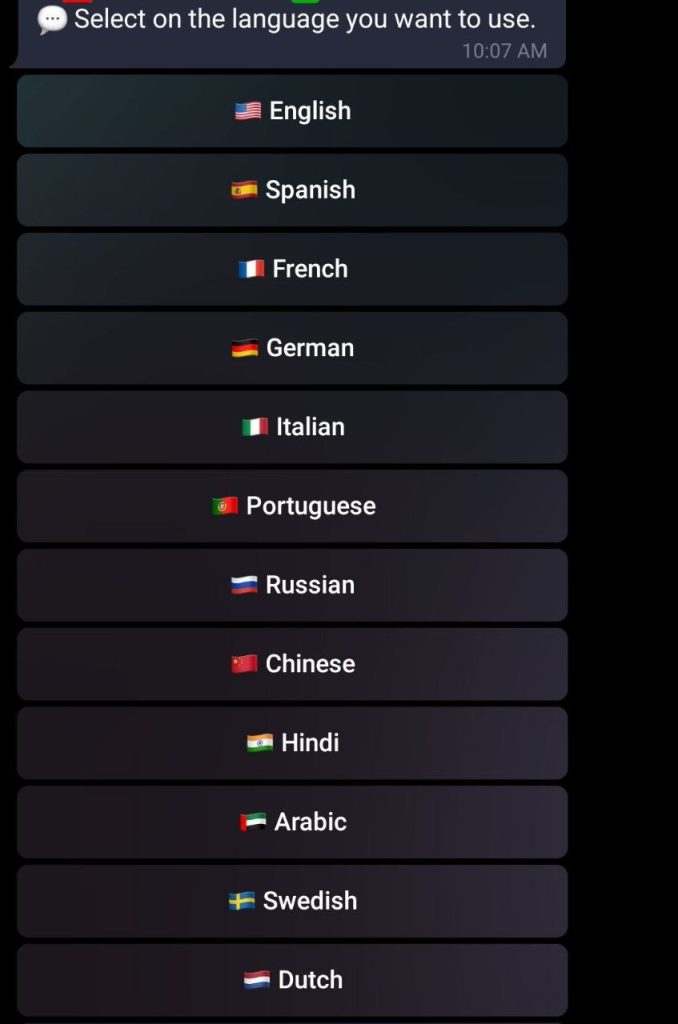

- You also can select a language for the bot to use when talking to the victim. The bot lets you choose from 12 languages of different language groups.

Language selection

- After the scammer selects a language, the bot offers to choose a voice. All of the voices are AI-generated, and you can choose a female or male one. Six regional varieties are available for English: U.S., British, New Zealand, Australian, Indian and South African.

Voice selection

- The bot lets you make a test call by entering a disposable number from the attacker’s pool.

- The bot is also able to detect if the call is redirected to voice mail. The bot will hang up if it is.

- The OTP bot in question supports custom scripts. In other words, the scammer can import their own scripts designed to imitate organizations that are not available among the options offered by the bot. The bot voices these custom scripts while you set up the call.

Interesting options offered by other OTP bots

As mentioned above, functionality varies from bot to bot. Besides what we’ve already explored, we have seen several advanced features with other OTP bots, listed below.

- Sending a text message as a heads-up about the impending call from an employee of a certain company. This is a subtle psychological trick aimed at gaining the victim’s trust: promise and then deliver. Furthermore, a disturbing message might leave the victim waiting anxiously for the call.

- Asking for other details during the call, besides the OTP. These may include the card number and expiry date, CVV, PIN, date of birth, social security number, and so on.

How scammers get the victim’s credentials

Since the bot is designed for stealing 2FA codes, it only makes sense to employ it if the scammer already has some of the victim’s personal details: the login and password for their account as well as a phone number at least, and their full name, address, bank card details, email address and date of birth at most. Scammers may get this information in several ways:

- From personal data leaked online;

- From datasets purchased on the dark web;

- Through phishing websites.

Phishing is typically how they get the most up-to-date credentials. Scammers will often want to save time and effort by harvesting as much information as possible during a single attack. We have come across many phishing kits targeting seemingly unrelated types of personal data.

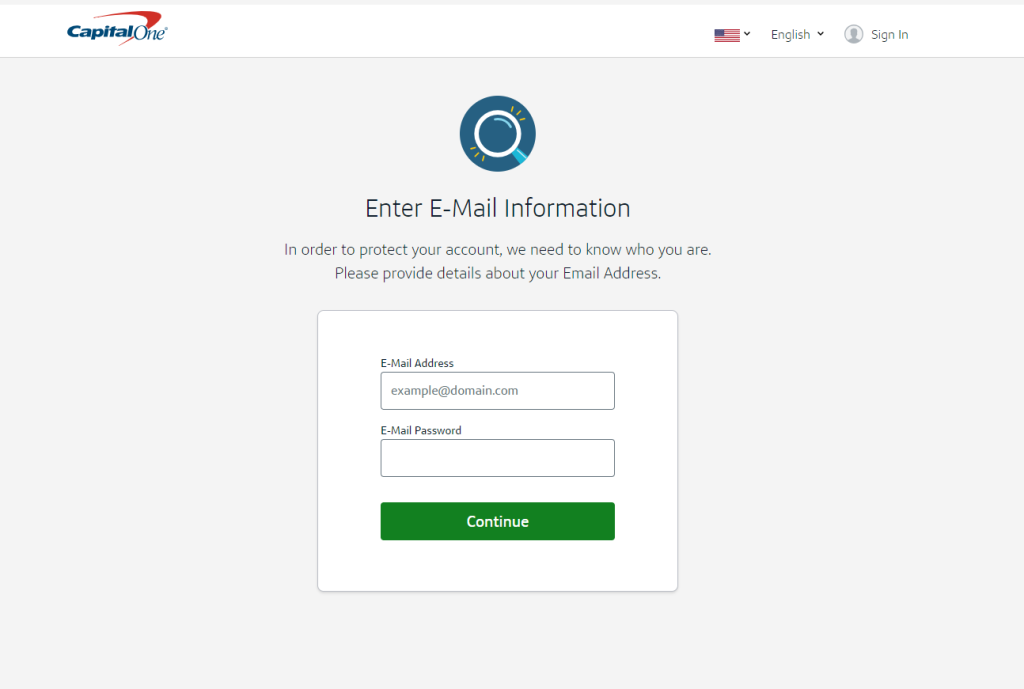

A kit may target a bank, but once the victim enters their login and password, they will be asked to provide their email address and the corresponding password. Equipped with that data and armed with an OTP bot, the scammer may be able to hack at least two of the victim’s accounts, and if the victim uses their email for authenticating with other websites, the scammer can inflict even more damage.

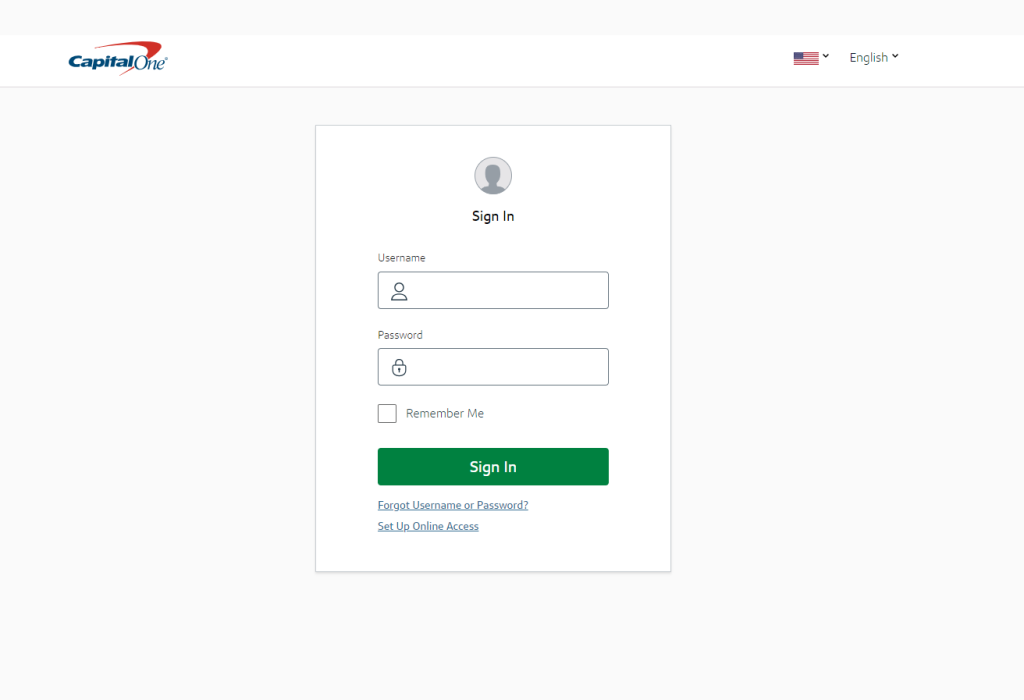

A sign-in form that imitates an online bank

A sign-in form that imitates an email service

Phishing in real time

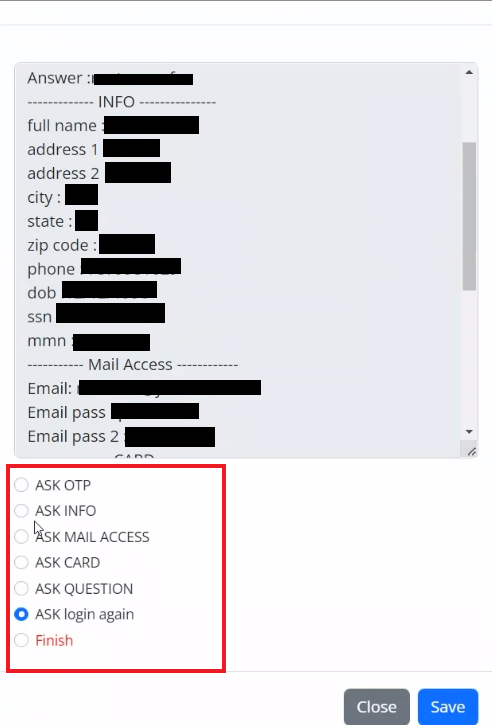

We have written about phishing kits that can be controlled via administration panels. As 2FA grew in popularity, the creators of phishing kits modified their admin panels by adding the functionality to intercept OTPs. This has enabled scammers to receive their victims’ personal data in real time to immediately use it.

These are multi-stage phishing attacks typically composed of the following steps.

Phishing site that imitates the online bank sign-in page

Fake OTP entry form

Admin panel options for requesting further personal details

The scammer’s admin panel displaying the data received from the victim

Statistics

Our bank phishing kit detection statistics can help form an assessment of potential damage done by OTP bots. In May 2024, our products prevented 69,984 attempts at visiting sites generated by this type of phishing kits.

Detection statistics for phishing kits targeting banks, May 2024 (download)

As we researched the subject, we also closely examined 10 multi-purpose phishing kits used for real-time interception of OTPs. In May 2024, our technology detected 1262 phishing pages generated by the kits in question.

Detection statistics for multi-purpose phishing kits, May 2024 (download)

The peak level during the first week of the month coincides with a surge in activity by one of the phishing kits.

Takeaways

While 2FA is a popular way of added account protection, it, too, can be bypassed. Scammers steal verification codes by using various techniques and technologies, such as OTP bots and multi-purpose phishing kits that they control in real time with the help of administration panels. In both cases, the user agreeing to enter the one-time code on the phishing page or while on a call with the OTP bot, is the crucial factor when trying to steal the code. To protect your accounts from scammers, follow our best practices as outlined below.

- Avoid opening links you receive in suspicious email messages. If you need to sign in to your account with the organization, type in the address manually or use a bookmark.

- Make sure the website address is correct and contains no typos before you enter your credentials there. Use Whois to check on the website: if it was registered recently, chances are this is a scam site.

- Do not pronounce or punch in the one-time code while you’re on the phone, no matter how convincing the caller sounds. Real banks and other companies never use this method to verify the identity of their clients.

- Use a reliable security solution that blocks phishing pages.

Source:: Securelist